©January 10, 2023

Daniel L. Ascani January 10, 2023

A simple Google search tells you what it is:

Modern Monetary Theory (MMT): “A macroeconomic theory that says countries that control their own currencies, like the U.S., are not constrained by revenues when it comes to government spending.” Investopedia.com

To dig a little further into Investopedia’s explanation of MMT:

Modern Monetary Theory (MMT) is a heterodox macroeconomic supposition that asserts that monetarily sovereign countries (such as the U.S., U.K., Japan, and Canada) which spend, tax, and borrow fiat currency that they fully control, are not operationally constrained by revenues when it comes to federal government spending.

Sounds a bit incestuous, doesn’t it? Even Ponzi-like. I mean, really – think about it. Taxing, borrowing, and spending the very currency a sovereign country controls without being constrained by revenues when it comes to federal government spending seems like a well-advertised shell game. So, instead of capping expenditures at the amount of revenues taken in, you just print the money you need to cover the costs of your greatest aspirations as a government.

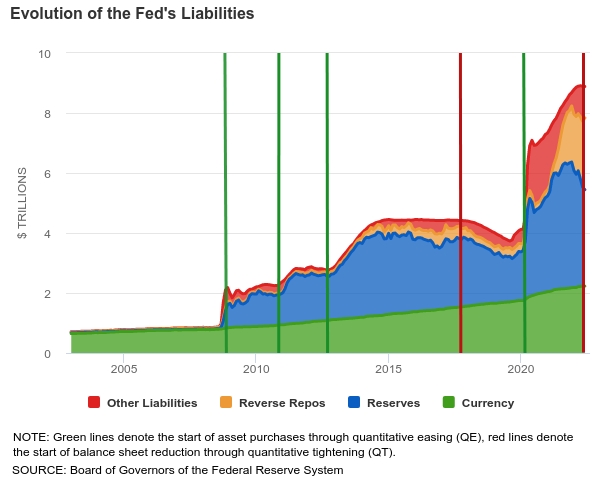

The Fed’s QE Becomes MMT on Steroids

That’s exactly what the U.S. and other countries decided to do years ago. Exacerbated by the deflationary collapse of 2008-2009, the governments and central banks of the major western economies threw all caution to the wind in order to put their MMT aspirations to the test by printing their respective economies out of the intensive care unit in which they all found themselves after that historic economic collapse… with you, me, and every citizen as involuntary guinea pigs in their latest experiment. They – the governments and central banks – are the self-proclaimed wizards, and we the people are the unwitting guinea pigs on whom this experiment is conducted.

It’s an experiment that the wizards must have enjoyed so much that they tried it again during the Covid crash and economic lockdown. There, they deployed MMT on steroids. The wizards not only once again pumped trillions of dollars into the economy, but they did so after manually shutting the economy down during the lockdown, even believing that everyone needed handouts straight from government printing presses. Checks were sent to virtually everyone, powered by money that didn’t exist.

To be sure, the government doesn’t actually “print” money. Instead, the Federal Reserve buys bonds from a seller, which delivers the bond to the Fed, and the Fed – with a simple keystroke – deposits money into that seller’s account. And violà – money created out of thin air, exacerbated by the Fed’s Quantitative Easing (“Q.E.”) policy and accompanied by all the moral hazards of manipulating the markets, all in plain view.

Then, there was inflation.

It’s almost as if the Fed and all of Congress completely forgot Economics 101. Pump enough money into the economy and you’ll get inflation. How can they possibly be surprised? Of course, it’s possible that Congress never studied Econ 101.

A Lesson Well Learned?

The government felt the full brunt of the lesson that is hopefully going to be well learned: You can’t, in fact, spend spend spend without consequences. This time – during the Covid crash episode, that is – they pumped so many trillions of dollars (to the tune of $5 trillion) into the economy that it caused an inflationary episode the likes of which the country hasn’t seen in some 40 years. Some have called it – and the associated QE of the past 14 years – the biggest Fed policy error in its history.

By most accounts, the government pumped $5 trillion into the economy during and after the Covid crash alone.

Add years of post-2008 crash QE and the Fed’s balance sheet exploded to nearly $9 trillion (Richmond Fed, Q3 2022 Econ Focus). In that $5 trillion pandemic stimulus spending alone, $1.8 trillion went to individuals and families, $1.7 trillion to businesses, $745 billion to state and local aid, $482 billion to health care, and $288 billion to “other.” (Where $5 Trillion in Pandemic Stimulus Money Went, NY Times, March 11, 2022).

Now, the Fed appears on track for another enormous policy error: How to claw back all that easy money that was, figuratively speaking, thrown from helicopters (remember “Helicopter Ben” Bernanke?) without plunging the economy into a hard recession.

And that’s the key: How do the wizards drain those trillions of dollars back off the Fed’s balance sheet and kill inflation without also killing the spending power of their much-needed guinea pigs? After all, what’s an experiment without your guinea pigs? You can’t just kill them off or you kill your own experiment.

But killing their own experiment is precisely what the Fed appears to be trying to do. And maybe that’s a good thing, because this experiment doesn’t work. On one hand, you throw all caution to the wind by invoking MMT to deal with the worst deflationary collapse since the Great Depression – a crash that signaled the failure of our current monetary system. Then, a few years later, you kill it in order to deal with the “whoops moment” the Fed finally had when it realized that, along with the government, it had caused the worst inflation in 40 years.

And during the decades since the United States dropped what was left of the gold standard in 1971, we’ve experienced far more frequent panics, crashes, and manias than ever before. Seems the wizards don’t have as much control over things as they think. They keep causing manias that then turn to panics and crashes. Rinse, repeat.

Yet this goes on right before our very eyes, in plain view and complete with press conferences after every Federal Open Market Committee meeting the Fed conducts.

It’s a lesson hard-learned, and with great moral hazard— the full extent of which has yet to play out.

Minting The World Reserve Currency: Seigniorage Masks Government Policy Errors

At least the U.S. still mints the world reserve currency to cover up some of its mistakes – an advantage called seigniorage that is perhaps the key reason the Fed has gotten away with this profound policy error for so long before the Piper finally had to be paid.

Although the topic of seigniorage is a subject that well deserves to be addressed in more detail < see our Tapping the Power of Gold report>, touching on it briefly now is relevant:

seign∙ior∙age – profit made by a government by issuing currency, especially the difference between the face value of coins and their production costs. Oxford Dictionary

In fact, the concept of seigniorage is so important and so relevant to today’s global macroeconomic trends that it is arguably the reason that central banks of the world accumulated the most gold in 55 years last year (Gold Demand Trends Q3 2022, World Gold Council). Seems that some other countries have grown tired of America’s seemingly perpetual advantage it holds by minting the world’s reserve currency. When world trade is paid for in US dollars, the US has a distinct advantage, and a growing number of foreign governments are growing tired of it. Hence, the accumulation of gold as a prelude to their potential future solutions.

Investors Need Be On Alert

So, what does the death of MMT, the advantage of seigniorage, and Fed policy errors mean for investors?

In a nutshell, it means enormous changes on the horizon – not just for investors, but for everyone. Those changes are likely to include a very different stock market due to a substantial reduction in liquidity formerly provided by the Fed’s easy-money policies; a change in some institutional strategies related to carry trades; a possible change to a more austere government fiscal policy that does not involve the intense deployment of MMT to fund them; and even the roots of a new monetary system (a recent Presidential executive order gave the go-ahead for “responsible development of digital assets and their underlying technology”). In the wake of the crypto industry collapse and crashing values of digital tokens such as Bitcoin and Ether, we may all benefit from blockchain technology, and the government is embarking on its own path to digital assets and the next version of their experiment designed to keep the status quo in place so they can retain power at the expense of its own citizens.

All the possibilities of today’s massive changes in the financial system and associated government and central bank policies are well beyond the scope of this piece. Suffice it to say, however, that acknowledging that massive change is upon us –and that the old is yielding to the new – is imperative for today’s investors and consumers.

It behooves those investors and consumers to plan aggressively for the changes that are to come. 2023 promises to be a year of great change. We believe that change will be greater than most are currently imagining, and we will be on top of them with our New Financial Order series of reports soon to be published.

For more, consider the following New Financial Order special reports, available on DefendingYourMoney.com:

What’s Really Moving the Stock Market These Days

Tapping the Power of Gold to Defend and Build Your Wealth

Today’s Frequent Market Crashes: Defending Your Wealth from Fed Policy Errors